Orange County NY Commercial Real Estate

Given the world financial state of affairs, you need to keep a close eye on different investment opportunities. Real estate, particularly commercial real estate, has always been an attractive investment to many. Do you know the changes in the commercial real estate market? Read below on our take on the commercial real estate outlook here at Chess Realty, specialists in Orange County NY commercial real estate. We additionally have the ability and insight to buy and sell not only your commercial real estate, but your business as well.

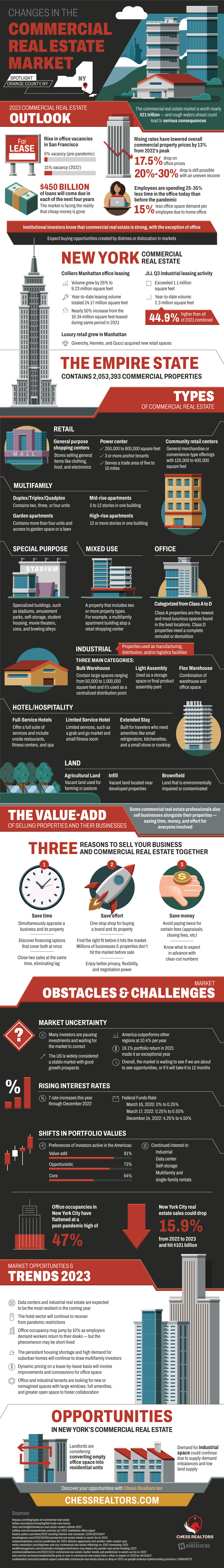

Learn more about Orange County NY commercial real estate in the infographic below:

Share this graphic on Orange County NY commercial real estate on your site!

The commercial real estate market is worth nearly $21 trillion — and rough waters ahead could lead to serious consequences

2023 Commercial Real Estate Outlook

- Rise in office vacancies

- San Francisco

- Pre-pandemic: 6% vacancy rate

- 2022: 15%

- San Francisco

- Rising rates have lowered property prices by 13% from 2022’s peak

- Office prices dropped 17.5%

- Prices could still drop 20-30% and see an uneven recovery

- Employees are spending 25-35% less time in the office today than before the pandemic

- Translates to 15% less office space demand per employee

- An estimated $450 billion of loans will come due in each of the next four years

- The market is facing the reality that cheap money is gone

- Institutional investors know that commercial real estate is strong, with the exception of office

- Expect buying opportunities created by distress or dislocation in markets

New York Commercial Real Estate

- Colliers Manhattan office leasing:

- Volume grew by 26% to 9.23 million square feet

- Year-to-date leasing volume totaled 24.17 million square feet

- Nearly 50% increase from the 16.34 million square feet leased during same period in 2021

- JLL Q3 industrial leasing activity

- Exceeded 1.1 million square feet

- Year-to-date volume: 2.3 million square feet

- 44.9% higher than all of 2021 combined

- Luxury retail grew in Manhattan

- Givenchy, Hermès, and Gucci acquired new retail space

Commercial real estate investors have many different types of properties to choose from

Types of Commercial Real Estate

- Retail

- General purpose shopping centers

- Stores selling general items like clothing, food, and electronics

- Power center

- 250,000 to 600,000 square feet

- 3 or more anchor tenants

- Serves a trade area of five to 10 miles

- Community retail centers

- 125,000 to 400,000 square feet

- General merchandise or convenience-type offerings

- General purpose shopping centers

- Multifamily

- Duplex/Triplex/Quadplex

- Contains two, three, or four units

- Garden apartments

- Contains more than four units

- Considerable access to garden space or a lawn

- Mid-rise apartments

- 5 to 12 stories in one building

- High-rise apartments

- 12 or more stories in one building

- Duplex/Triplex/Quadplex

- Office

- Categorized from Class A to D

- Class A properties are the newest and most luxurious spaces found in the best locations

- Class D properties need a complete remodel or demolition

- Categorized from Class A to D

- Industrial

- Properties used as manufacturing, distribution, and/or logistics facilities

- Three main categories:

- Light Assembly

- Used as a storage space or final product assembly pant

- Flex Warehouse

- Combination of warehouse and office space

- Bulk Warehouse

- Large spaces ranging from 50,000 to 1,000,000 square feet

- Used as a centralized distribution point

- Light Assembly

- Hotels/Hospitality

- Full-Service Hotels

- Offer a full suite of services and include onsite restaurants, fitness centers, and spa

- Limited Service Hotel

- Limited services, such as a grab and go market and small fitness room

- Extended Stay

- Built for travelers who need amenities like small refrigerators, kitchenettes, and a small stove or cooktop

- Full-Service Hotels

- Land

- Agricultural Land

- Vacant land used for farming or pasture

- Infill

- Vacant land located near developed properties

- Brownfield

- Land that is environmentally impaired or contaminated

- Agricultural Land

- Mixed Use

- A property that includes two or more property types

- For example, a multifamily apartment building atop a retail shopping center

- Special Purpose

- Specialized buildings, such as stadiums, amusement parks, self-storage, student housing, movie theaters, zoos, and bowling alleys

Multiple factors are impacting the commercial real estate market — from market uncertainty and rising interest rates, to inflation and shifting investment priorities

Market Obstacles & Challenges

- Market uncertainty

- Many investors are pausing investments and waiting for the market to correct

- However, the US is widely considered a stable market with good growth prospects

- America outperforms other regions with an average of 10.4% per year

- 19.1% portfolio return in 2021 made it an exceptional year

- Overall, the market is waiting to see if we are about to see opportunities, or if it will take 6 to 12 months

- Rising interest rates

- Seven rate increases this year through December 2022

- Federal Funds Rate

- March 16, 2020: 0% to 0.25%

- March 17, 2022: 0.25% to 0.50%

- December 14, 2022: 4.25% to 4.50%

- Shifts in portfolio values

- Preferences of investors active in the Americas:

- Value add: 81%

- Opportunistic: 73%

- Core: 54%

- Continued interest in:

- Industrial

- Multifamily and single-family rentals

- Self-storage

- Data centers

- Preferences of investors active in the Americas:

- Layoffs in New York businesses could reduce demand for commercial real estate

- Twitter & Meta layoff 1,289 workers in November 2022

- Goldman Sachs planning to lay off 4,000 workers

- Office occupancies in New York City have flattened at a post-pandemic high of 47%

- New York City real estate sales could drop 15.9% from 2022 to 2023 and hit $101 billion

Despite the obstacles, there are opportunities in the commercial real estate market for those willing to embrace the risk

Market Opportunities & Trends 2023

- Data centers and industrial real estate are expected to be the most resilient in the coming year

- The hotel sector will continue to recover from pandemic restrictions

- Office occupancy may jump by 10% as employers demand workers return to their desks — but the phenomenon may be short-lived

- The persistent housing shortage and high demand for suburban homes will continue to draw multifamily investors

- Dynamic pricing on a lease-by-lease basis will involve improvements and concessions for office space

- Office and industrial tenants are looking for new or reimagined spaces with large windows, full amenities, and greater open space to foster collaboration

- Opportunities in New York’s Commercial Real Estate

- Landlords are considering converting empty office space into residential units

- Silverstein Properties announced a $1.5 billion capital raise to convert Manhattan office buildings into residential housing

- Demand for industrial space could continue due to supply-demand imbalances and low land supply

- 2023 hotel occupancy tax revenue could reach $514 million

- 49% increase from 2022

- Landlords are considering converting empty office space into residential units

Commercial real estate remains a wise investment for those who understand the market

Discover your opportunities with Chess Realtors Inc

Sources:

https://www.marketwatch.com/story/realtors-expect-vulnerable-commercial-real-estate-prices-to-drop-in-2023-as-people-embrace-hybrid-working-practices-11668456776

https://www.msn.com/en-us/money/realestate/the-party-is-over-in-commercial-real-estate-here-s-what-to-expect-in-2023/ar-AA15z6LF

https://www.wealthmanagement.com/investment-strategies/institutions-may-deploy-dry-powder-real-estate-heading-2023

https://finance.yahoo.com/news/2022-stunning-interest-rate-increases-120041637.html?

https://www.forbes.com/advisor/investing/fed-funds-rate-history/

https://fnrpusa.com/blog/types-of-commercial-real-estate/

https://www.cbre.com/insights/books/us-real-estate-market-outlook-2023

https://www.reeseonrealestate.com/cre-predictions-for-2023-distress-opportunity-and-another-roller-coaster-year/

https://investingincre.com/2022/09/09/commercial-real-estate-trends-to-watch-for-in-2023/

https://commercialobserver.com/2022/10/10-commercial-real-estate-market-trends-and-predictions-to-watch-out-for-in-2023/

https://www.colliers.com/en/research/new-york/nyc-q3-2022-manhattan-office-report

https://www.metro-manhattan.com/blog/new-york-city-commercial-real-estate-reflecting-on-2022-foreseeing-2023/